Broker Fees and Medical Schemes Membership, South Africa

Michael Mncedisi Willie, Sipho Kabane and Clarence Mini

Council for Medical Schemes, South Africa

- *Corresponding Author:

- Michael Mncedisi Willie

Council for Medical Schemes, South Africa

E-mail: m.willie@medicalschemes.com

Received Date: July 21, 2020; Accepted Date: July 28, 2020; Published Date: August 04, 2020

Citation: Willie MM, Kabane S, Mini C (2020) Broker Fees and Medical Schemes Membership, South Africa. Med Clin Rev. Vol. 6 No. 2: 97.

DOI: 10.36648/2471-299X.6.2.97

Broker Fees and Membership-Trend

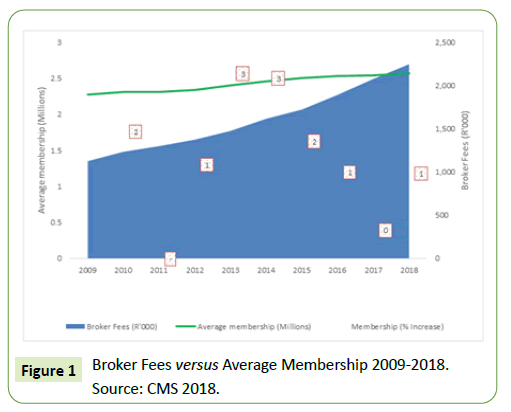

Medical scheme membership is used as a proxy for assessing medical scheme performance in terms of enrolees into the schemes. Increasing membership is primarily driven by new enrolees, which potentially implies a higher contribution income for the scheme and thus a possible increase in the bottom line of the scheme. Membership in medical schemes has been stagnating in the region of eight million for the past decade [1]. Non-health care costs which include broker fees marketing and distribution costs have been increasing and outstripping membership growth

in the sector, as depicted in Figure 1 below.

Broker fees are largely seen in open schemes that freely admit beneficiaries and they account for approximately fourteen percent (14%) of non-healthcare costs. In many instances, the increase in marketing costs is not correlated to growth in membership. Studies have shown that poor marketing strategies lead to poor organizational performance. Rodriguez, Peterson and Vijaykumar [2] noted that most companies have failed to record an increase

in their sales revenue, due to poor marketing strategies.

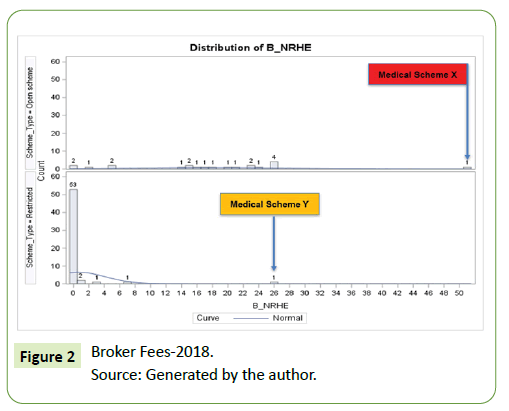

Figure 2 below depicts medical scheme broker fees as a percentage of non-relevant health care expenditure; being as high as fifty percent (50%), which is significant and is not correlated to membership growth over time. Though only five of the fifty-eight

(58) employer-based schemes are attracting broker fees, it is still a concerning phenomenon that these employer-based types of

medical schemes also attract broker fees which in some instances

can be as high as twenty-six percent (26%). Employer-based types

of medical schemes should not be attracting broker fees.

Capping of broker fees as per section-Section 65 of the Medical Schemes Act

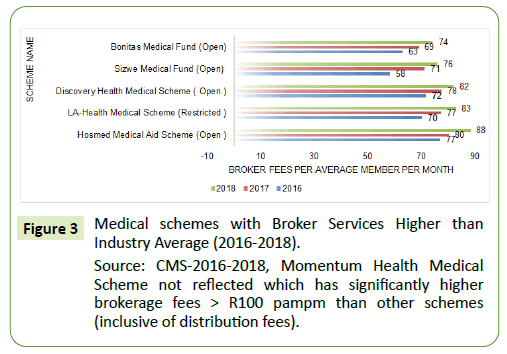

In 2018, the Minister of Health announced an increase in the maximum amount payable to brokers by medical schemes in respect of broker clients who are members of medical schemes, in terms of Section 65 of the Medical Schemes Act. The amount was increased to rupees 90.00 per member per month, with effect from 1 January 2018 [3]. Momentum Health Medical Scheme has broker fees per average member per month exceeding R100 and this is not consistent with the legislated maximum. The 2018 annual report depicted an industry average of R72.75 per member per month. A total of five (5) medical schemes had broker service fees that were higher than the industry average and these trends had been consistent over the previous five (5) years. The five (5) schemes data needs to be critically assessed to gain insights into the main drivers of these schemes.

Medical Scheme Amendment Bill and the role of Brokers

The trajectory on how the role of healthcare brokers in medical schemes is depicted in the Medical Aid Scheme Amendment Bill showed that almost two-thirds of medical scheme members pay more than R2.2 billion to brokers and in many instances, these members have never been in contact with nor have they ever met the broker. The slow growth of membership in medical schemes must be understood as being the role that brokers have in stimulating membership.

Similarly, active participation in terms of visibility to members is also key. Size Medical Scheme broker service fees increased significantly over the past three (3) years by nearly two thirds (31%). The scheme membership declined by nearly ten (10) percent over the same period. Similarly, the LA Health Medical Scheme and Bonitas Medical Fund both increased by nearly a fifth (18%), over the period.

It is noteworthy that the five (5) schemes depicted in Figure 3 accounted for seventy-one percent (71%) of the membership in 2018 and for seventy-eight percent (78%) of the total brokerage costs, which is a staggering figure [1]. It is indeed a major concern that these costs are increasing at an alarming rate and yet members are not receiving any form of brokerage fees. In many instances’ members are not even aware that they are contributing towards brokers’ services.

All the schemes depicted in Figure 3 above experienced membership losses except for Discovery Health Medical Scheme and the LA-Health Medical Scheme. It is important to note that Discovery Health Medical Scheme merged with the Witwatersrand Medical Scheme, which indicated that the membership growth could be as a result of the merge, rather than just reflecting the organic growth of the scheme. LA-Health membership has been growing at an increasing rate over the past few years (Table 1).

Table 1: Membership growth of schemes with Brokerage Services higher than Industry Average (2016-2018).

| Scheme Name | % Growth in beneficiaries (2016-2018) |

|---|---|

| Discovery Health Medical Scheme | 3% |

| La-Health Medical Scheme | 25% |

| Sizwe Medical Fund | -9% |

| Bonitas Medical Fund | -6% |

| Hosmed Medical Aid Scheme | 16% |

Momentum Health Medical Scheme not reflected which has a

significantly higher brokerage fee >R100 pampm than other schemes

(inclusive of distribution fees)

The Health Market Enquiry and the Role of Brokers

The findings of the Health Market Inquiry (HMI) report that was released in 2019 depicted that the brokers’ interests should be aligned more closely with those of the applicants and the members. The report also found that brokers could still play a significant role in healthcare. The following recommendations are drawn from the report [4]:

• That the broker system must change to an active opt-in system so that the interests of brokers and scheme members are more closely aligned. Members will be required, on an annual basis, to declare whether they want to use the services of a broker. For those who do, the scheme will facilitate the payment to the broker. Members who choose not to use the services of a broker will pay proportionally lower scheme membership fees.

• Members must be free to choose any licensed broker they wish and not just those that are contracted with schemes. • Brokers who are marketers for a specific scheme (and are thus not independent) should earn lower commissions than independent agents.

• Medical schemes must report broker fees separately from distribution and other marketing fees to the CMS. The CMS must also make these separate figures available in the annual report

• As a condition of registration, medical schemes must also be able to deal directly with the public without the use of brokers. This would include administering membership applications.

Conclusion

What is concerning about the broker fees levied by medical schemes is that they do not seem to be aligned with members’ needs. The HMI report revealed that Consumer information was incomplete, and the role of brokers and other agents in directing consumer choice was questionable. Other potential problems with brokerage fees are that these fees cover a significant portion of covered lives and yet members are not even aware of the services rendered. Scheme performance in terms of members in most instances is not correlated to significant increases in broker service fees.

One of the recommendations which are also consistent with HMI findings is to give members an option to choose the services of a broker and this must also be aligned with the fees associated with the services. There should be clearly defined Key Performance Indicators (KPIs) between schemes and brokers and these should also ensure that pay for performance indicators are delinked from costs involved with moving members from one scheme to another. Such contracts should ensure that remuneration should be a function of recruiting virgin members to the schemes. Lastly, these contracts should also cover member interaction and advice provided and these should be monitored on an ongoing basis.

References

- Council for Medical Schemes (2018) Annual Report 2017/2018. Pretoria: Council for Medical Schemes.

- Rodriguez M, Peterson P, Vijaykumar K (2012) Social Media’s Influence on Business-to-Business Sales Performance. J Pers Sell Sales Manag 32: 365-378.

- Council for Medical Schemes (2017) Annual Report 2016/2017. Pretoria: Council for Medical Schemes.

- http://www.compcom.co.za/wp-content/uploads/2014/09/Health-Market-Inquiry-Report.pdf

Open Access Journals

- Aquaculture & Veterinary Science

- Chemistry & Chemical Sciences

- Clinical Sciences

- Engineering

- General Science

- Genetics & Molecular Biology

- Health Care & Nursing

- Immunology & Microbiology

- Materials Science

- Mathematics & Physics

- Medical Sciences

- Neurology & Psychiatry

- Oncology & Cancer Science

- Pharmaceutical Sciences